Ohio Justice Center – Columbus

At Royse Partners Limited, we can serve your business by providing comprehensive Section 174 analyses to ensure your business remains compliant with IRS regulations on research and experimental (R&E) expenditures. Our team partners with Attorneys, CPAs, and industry experts to offer tailored solutions that optimize your financial strategy and tax planning. With the recent changes in tax legislation, it is more important than ever to accurately account for and amortize your R&E expenses appropriately.

Let Royse Partners guide you through the complexities of Section 174 and provide peace of mind, allowing you to focus on your Company’s innovation and growth.

Section 174 of the Internal Revenue Code (IRC) has long statutorily provided essential accounting methods for businesses engaged in research and experimentation (R&E) activities. Originally enacted in 1954, Section 174 allowed businesses to immediately deduct expenses related to R&E in the year incurred, thereby encouraging innovation and development. This tax provision has played a critical role in supporting businesses as they invested in new technologies, products, processes, and more.

Beginning in tax year 2022, all businesses are now required to capitalize their R&E expenditures and amortize them over a five-year period for domestic expenditures, and a 15-year period for foreign expenditures. This significant change mandated the shift from immediate deduction in the year such expenses are incurred to one of mandatory capitalization and amortization.

2021 (Previous § 174) | 2022 (§ 174 Changes) | 2023 (§ 174 Changes) | |

|---|---|---|---|

Revenue | $1,000,000 | $1,000,000 | $1,000,000 |

R&E costs paid during the year | $1,000,000 | $1,000,000 | $1,000,000 |

Of which deductible for the financial year | $1,000,000 | $100,000 | $300,000 (10% for 2022 20% for 2023) |

Profit | $0 | $900,000 | $700,000 |

Corporate Tax Due (Assuming 21% Tax Rate) | $0 (Due in 2022) | $189,000 (Due in 2023) | $147,000 (Due in 2024) |

Compliance with Section 174 is mandatory, and businesses must ensure they remain cognizant of such updated laws and regulations. Critical compliance measures include the accurate identification and tracking of R&E expenses, maintaining detailed records, and adjusting accounting methods to accommodate requisite amortization requirements.

Section 174 expenses refer to research and experimental (R&E) expenditures a company may incur in connection with its trade or business. Section 174 expenses are specifically related to activities intended to discover information that would eliminate uncertainty in the development or improvement of a product.

Moreover, this significant legislative revision to Section 174 specifically enumerates the development of any software to be categorized as an R&E expenditure.

Section 174 of the IRC impacts a diverse range of business entities, including:

Sole Proprietorships & Partnerships – Although typically smaller in scale, these entities can significantly benefit from qualifying Section 174 deductions.

Limited Liability Companies (LLC) – An LLC can elect its tax classification (sole proprietorship, partnership, S corporation, or C corporation), allowing it to strategically benefit from Section 174 deductions based on its chosen tax structure.

Young/Start-Up Businesses – Frequently, these entities invest significant time and resources in research and experimentation, thereby enabling many of the company’s activities to be categorized as Section 174 expenses.

Corporations – Both S corporations and C corporations are impacted by Section 174, provided such entities have research and experimentation expenditures.

As such, a broad range of taxpayers are likely to have Section 174 expenditures that now must be capitalized and amortized, including but not limited to businesses that engage in the following:

Consequently, companies engaged in developing new products or materials, such as those in technology, pharmaceuticals, consumer goods, and chemical and material sciences industries will need to adjust internal accounting methods alongside their long-term financial strategies. Additionally, manufacturers and automotive firms focused on improving processes, as well as businesses in the energy sector researching alternative energy sources will be impacted. These changes necessitate careful financial planning and consideration of long-term impacts on cash flow and related financial statements.

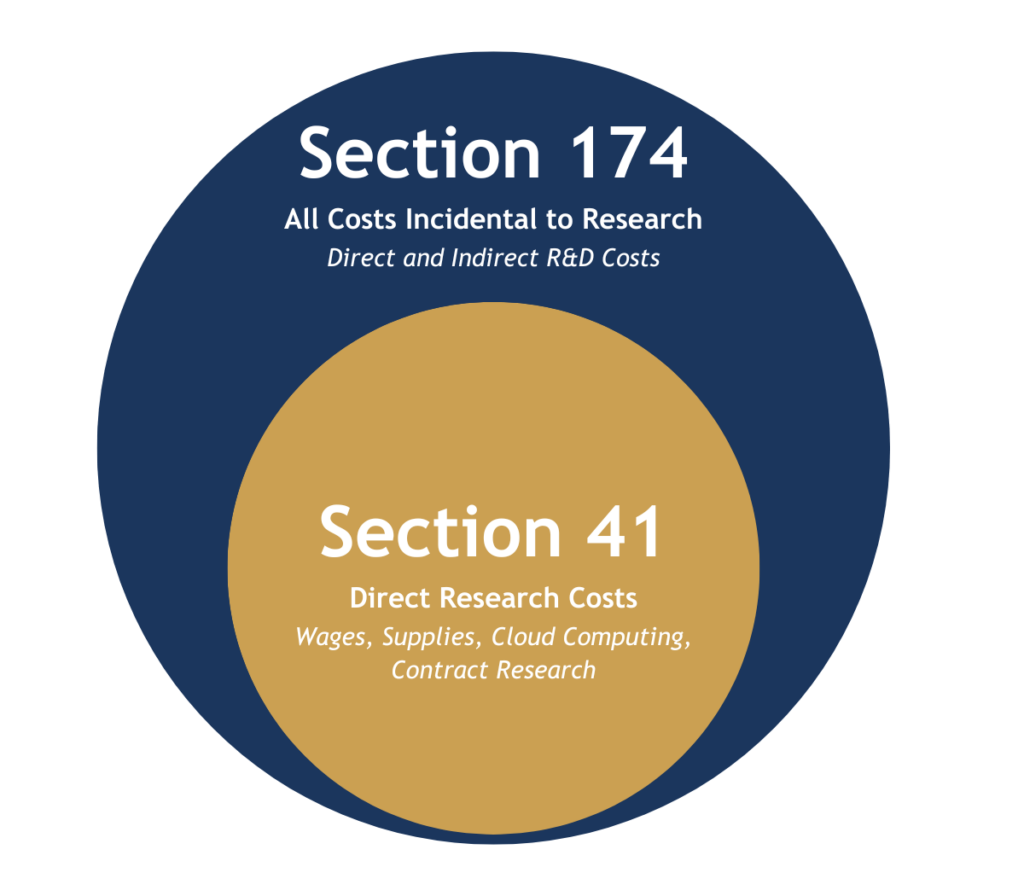

Section 174 of the IRC addresses the deduction of R&E expenses, while Section 41 details the Credit for Increasing Research Activities, often referred to as the Research and Development (“R&D”) Tax Credit. Section 41 incentivizes businesses to invest in innovation by rewarding certain qualifying expenses or activities with a tax credit.

As Section 174 encapsulates the very expenses associated with Section 41, all R&D expenditures would be categorized as Section 174 expenses. Conversely, not all Section 174 expenses are Qualified Research Expenses (“QREs”) under Section 41. It is imperative to distinguish and track each expense associated with the appropriate R&D or R&E activities in order to properly capitalize and amortize the necessary expenses.

At Royse Partners, we simplify Section 174 compliance by conducting a comprehensive analysis of your R&E expenditures and generate precise amortization schedules, to be used by your tax professional for annual filings. Our team of experts provide ongoing consultation and supports your finance and accounting team as they forecast expenses and budget for projects. Our continuous support keeps your business compliant with the latest regulations and will proactively communicate legislative updates.

As a result of the Tax Cuts and Job Act (TCJA) in 2017, amortization of Section 174 expenses were required beginning in tax year 2022.

If you have any expenses that may be considered “research and experimentation,” yes. If your company does not conduct any developmental activities, then these changes may not impact you. You should always seek the guidance of your trusted tax professional to determine whether such changes apply.

Yes! If you qualify. The Research and Development Tax Credit helps offset some of the additional tax liability incurred by the new amortization requirements.

Maybe. There are several legislative bills that include a “fix” (permitting the allowance of full Section 174 deductions in the tax year incurred) to Section 174. However, this legislation remains pending in Congress and has not yet become law. We at Royse Partners are hopeful that such a legislative fix becomes law and that taxpayers will go back to being able to deduct 100% of R&E expenses in the year incurred. Nonetheless, we recommend compliance with current IRS regulations to avoid non-compliance penalties and fees.

Ensuring compliance with Section 174 is essential to avoid tax penalties, fines, and interest. Accurate identification and tracking of R&E expenses are critical for financial accuracy, preventing errors in financial statements, and operational impacts. Detailed record-keeping and adherence to amortization requirements prepare taxpayers for audits and ensure they can demonstrate regulatory compliance. By adhering to Section 174 requirements, taxpayers can fully benefit from R&D tax credits without the risk of disqualification or reduced benefits. Compliance also enhances a taxpayer’s reputation with stakeholders and avoids the complexity and costs of retroactive financial adjustments.

New regulations require all domestic R&E expenses to be amortized over a period of 5 years, and 15 years for foreign expenses. This change means that R&E expenses will no longer be fully deductible in the year incurred, thereby impacting financial statements by spreading the expenses over a several-year period. As the expenses will not be fully deducted in the year incurred, the net income of a company may be higher, thus increasing current taxable income. Higher taxable income results in higher tax liability, which may result in higher tax payments. Such changes make planning for cash flow and accurate reporting much more difficult if R&E expenses are not properly tracked and amortized over the applicable period.

Allow our team to conduct a complimentary tax analysis with you today!

© 2024 Royse Partners Limited. All rights reserved. | Website by Brave Little Beast